Underpayment penalty calculator

You didnt make a required payment because of a casualty event disaster or other unusual circumstance and it would be inequitable to impose the penalty or. Failure to File Timely Return.

Excel Template Tax Liability Estimator Mba Excel

Please be aware that this calculator only computes penalties for late filing and late payment.

. The penalty is essentially an interest charge. Reach this FindLaw article to learn more. When current year AGI exceeds 150000 75000 if married filing separately but is less than 1000000 500000 if married filing separately they must pay in 110 of the prior years amount to avoid the penalty.

Generally an underpayment penalty can be avoided if you use the safe harbor rule for payments described below. Not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term. IRS interest rates will remain unchanged for the calendar quarter beginning April 1 2021.

If your tax return shows a balance due of 540 or less the penalty is either. 10 of the underpayment. By using this site you agree to the use of cookies.

If this happens the IRS may impose an accuracy-related penalty thats equal to 20 of your underpayment. The interest rate for underpayments by individual taxpayers for the fourth quarter of 2022 is 6. You pay at least 90 of the tax you owe for the current year or 100 of the tax you owed for the previous tax year or.

1 per month or fraction thereof of the unpaid tax up to a maximum of 25. It increased a full percentage point from the third quarter of 2022 and 3 from Q4 2021. The law allows the IRS to waive the penalty if.

Certain Virginia corporations with 100 of their business in Virginia and federal taxable income of 40000 or less for the taxable year may qualify to electronically file a short version of the return eForm. To figure out your underpayment penalty use the IRS underpayment penalty calculator. In the US federal income taxes are a pay-as-you-go system.

This penalty is charged when you fail to pay your taxes by the due date. The maximum penalty is 25 of the additional taxes owed amount If both the failure-to-file and the failure-to-pay penalties are owed for the same month the failure-to-pay penalty is waived for that month. However failure to pay penalty relates to taxes that you determine as payable while filing tax return or IRS has.

Type of Civil Penalty. Individuals with annual AGI of 1000000 or more must pay in 90 of the current years tax to avoid a penalty. IRS Penalty Interest Rates.

Is failure to pay penalty and underpayment penalty the same. 62C 33a Failure to Pay a Tax When Due. For instance if your balance is.

Find wages and penalty rates for employees. Resources IRS Interest Rates. That means taxes are due when you earn the income not when your tax return is due.

Safe harbor-100 of prior year. Tax on Joint Return Exceeds Tax on Separate Returns. In addition interest must be accrued on underpayments and late payments of tax as well as on the unpaid balance of any assessment that is more than 30 days old.

The penalty is equal to 100 of the amount due. If you dont pay in throughout the year youll likely get hit with an underpayment penalty. Open pay calculator tool Pay calculator tool.

100 of the amount due. Underpayment of Estimated Tax Penalty Calculator. All corporations can file their annual income tax return Form 500 and pay any tax due using approved software products.

Further you can also file TDS returns generate Form-16 use our Tax Calculator. For taxpayers other than corporations the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points. 1 per month or fraction thereof of the unpaid tax up to a maximum of 25.

Find how to figure and pay estimated taxes. The penalty is 135. Whichever amount is less.

The maximum penalty is 25. The provided calculations do not constitute financial tax or legal advice. Allowances penalty rates.

Work out annual and personal leave. This rate is determined by the IRS on a. This means the IRS requires you to pay estimated taxes throughout the yeareither via withholding from paychecks or by making.

You may avoid the Underpayment of Estimated Tax by Individuals Penalty if. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. This penalty is equal to 005.

This is the main reason to stay on top of your tax payments. The IRS will not charge you an underpayment penalty if. Failure to Pay Penalty.

As an example if the failure to include your miscellaneous income caused you to understate your tax liability by 5000 your penalty would be 1000 5000 x 20 1000 if the IRS determines that it was a substantial understatement of. IRS imposes an underpayment penalty if a person fails to make estimated tax payments either fully or to the extent of periodic estimated taxes throughout the year. To avoid a penalty pay your correct estimated taxes on time.

It cannot be used to compute the penalty for underpayment of estimated tax by individuals fiduciaries Single Business Tax and Michigan Business Tax. Use the Online Penalty and Interest Calculator to calculate your penalty and interest or follow the instructions in Pub 58 Utah Interest and PenaltiesWe will send you a bill if you do not pay the penalties and interest with your return or if the penalty andor interest is calculated incorrectly. When you sign a statement under penalty of perjury you may be found guilty of a crime if you knowingly lie in your statement.

This IRS overpayment interest calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates of IRS interest on tax debt. The IRS late filing penalty is set to 05 of the tax owed after the due date and for each month the tax remains unpaid up to 25. 31 March 2018 was the deadline for filing belated return for AYs 2018-19 2019-20.

Limited Liability Company LLC Fee Estimate Penalty. 5 for large corporate underpayments. 6013b5 Tax on a joint return exceeds tax shown on separate returns due to negligence or intentional disregard of rules.

Pay during inclement or severe weather natural disasters. Our tax system is based on a pay-as-you-go rule. The IRS recently announced they will now waive the penalty for underpayment if you at least paid 80 of your 2018 tax liability further reducing the relief IRS originally announced on Jan16.

Penalties and Interest for Individuals Virginia law requires us to assess penalties for underpayment of tentative tax extension penalty late filing and late payment. Use Form 2210 Underpayment of Estimated Tax by Individuals Estates and Trusts to see if you owe a penalty for underpaying your estimated tax. Underpayment of Estimated Tax Penalty Calculator.

Underpayment of estimated fee. If you are filing your return or paying any tax late you may owe penalties and interest. Between 135 and 540.

Belated return Penalty for Late Filing of Income Tax Return - Read this article to know how to file belated returns and what are the consequences of late filing of return. How to File and Pay Annual income tax return. The IRS sets the rate each quarter at the federal short-term rate plus three percentage points.

Open leave calculator tool Leave calculator tool. The penalty is only 025 on installment plans if a taxpayer filed the tax return on time and the taxpayer is an individual. The adjustment was made by the IRS in an effort to help taxpayers who were unable to adjust their withholding and estimated tax payments to reflect.

Estimated Quarterly Taxes How To Calculate And File Zipbooks

Calculate Estimated Tax Penalties Easily

The Complexities Of Calculating The Accuracy Related Penalty

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

.jpg)

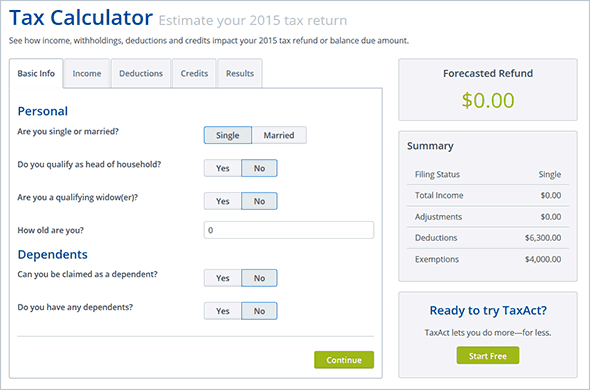

Income Tax Calculator Estimate Your Refund In Seconds For Free

The Complexities Of Calculating The Accuracy Related Penalty

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

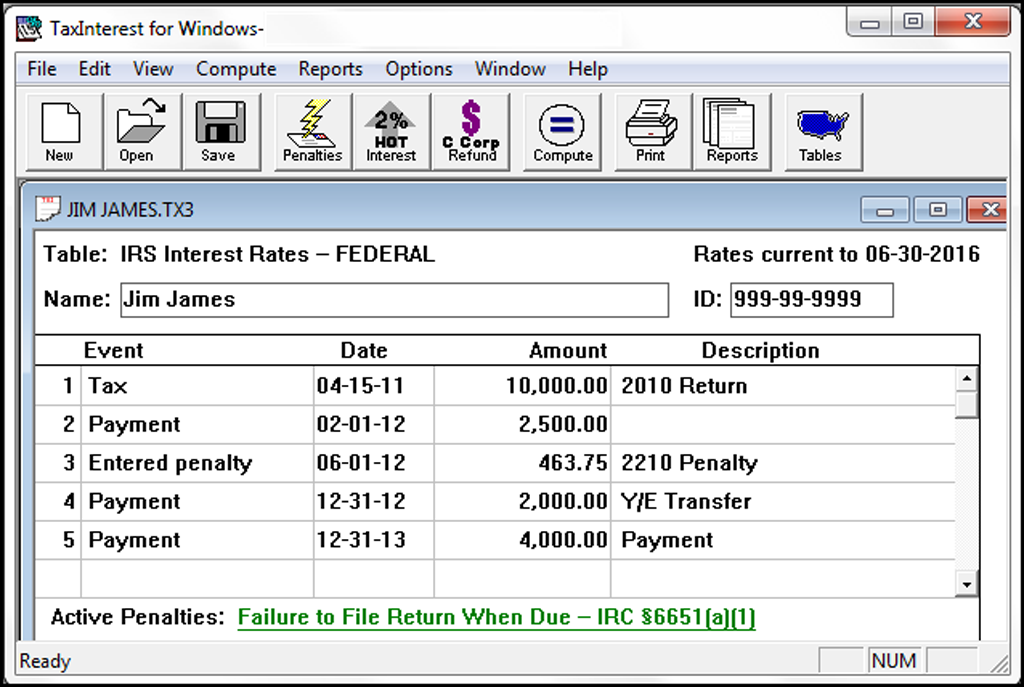

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Excel Template Tax Liability Estimator Mba Excel

Taxinterest Irs Interest And Penalty Software Timevalue Software

The Complexities Of Calculating The Accuracy Related Penalty

11422 Suppressing Underpayment Penalty And Form 2210 1 Jpg

How To Calculate Estimated Taxes The Motley Fool

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Strategies For Minimizing Estimated Tax Payments

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Excel Template Tax Liability Estimator Mba Excel